The industry’s most comprehensive global consortium data for fraud prevention

The global anti-fraud consortium data pioneer

The Most Accurate Fraud Detection in the Industry

in fraud prevented annually

transactions flagged annually

false-positive ratio

More Effective Fraud Prevention through Consortium Data Intelligence

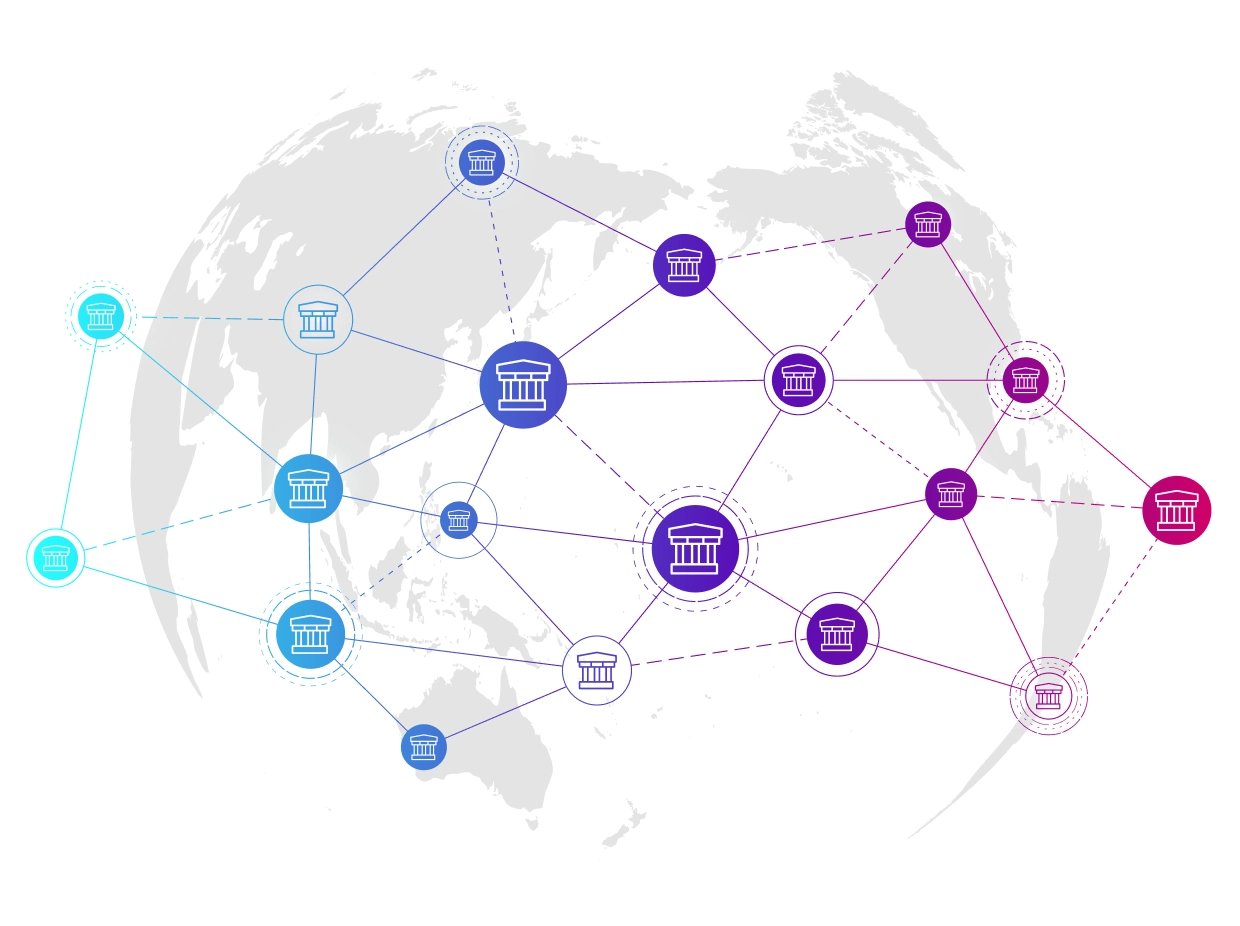

The Outseer Global Data Network is a collaborative data consortium that allows for near real-time sharing of high-quality signals from confirmed fraud events and indicators into emerging threat patterns. The globally-sourced transaction intelligence spans the largest financial institutions in the world, with hundreds of contributors in over 150 countries, resulting in around 830k transactions flagged and significant potential fraud prevented daily. By using these shared network signals, financial institutions can proactively identify fraud or attempted fraud based on data elements. The data fuels insights that can be used to drive decisions to protect and authenticate customers.

Anti-fraud consortium data pioneer with decades of experience

Outseer provides customers with Global Data Network capabilities that have been proven for over a decade and fine-tuned to offer market leading insights and low false-positives

Globally sourced data signals catch more fraud

Our globally sourced fraud, identity and transaction intelligence spans hundreds of the largest financial institutions in the world, including digital banking providers, card issuers, and issuer processors

Fast insights into emerging threats

The data consortium's collaborative nature allows for near real-time sharing of fraud-related data, ensuring that participating organizations remain up to date on emerging threats and confirmed fraud

Collective Global Data & Intelligence

The Outseer Global Data Network collects signals and interactions with active collaboration from an extensive network of contributors. The Global Data Network takes the successful, failed, or challenged transactions and combines these insights with intelligence from case marking of confirmed or suspected fraud and confirmed or suspected genuine transactions.

When combined with advanced analytics and predictive AI, the near real-time, aggregated data enables financial institutions to benefit from the collective fraud intelligence to catch more fraud, quicker.

Outseer supports the aggregation of information of different entities across multiple solutions in card payments and digital banking.

Aggregating Data from Multiple Sources Improves Intelligence

Outseer supports the aggregation of information of different entities across multiple solutions in card payments and digital banking. Shared intelligence signals include:

- Mobile device identifiers

- Merchant ID

- Account ID

- IP & geolocation

- Hashed International Bank Account Number (IBAN) payee

- Browser cookies and other device data signals

- Device fingerprint

- Swift payee

- MAC address

- Cookies

- IPs

- Fraud patterns

- Emails & Email Domains

Try Our Platform of Solutions

Global Data Network Process

The fraud intelligence information within the Global Data Network is captured and updated by contributing customers and partners.

Marked as Fraud

When an event or transaction is marked as confirmed or suspected fraud, the data is stored. PII-compliance is maintained to comply with GDPR regulations.

Analysis & Scoring

The data entities undergo an analysis and scoring process. When an interaction includes data seen before in the Global Data Network, the risk associated with that signal is automatically adjusted.

Updates are Shared to Consortium

Updated risk signals are shared to all consortium members in near real time, immunizing the network against known bad actors.

Powering the Outseer Platform

The Global Data Network Powers the Risk Engine

The Outseer Global Data Network informs the Outseer Risk Engine, which creates a fraud risk score that powers the Outseer Platform, leading to high fraud detection and prevention rates. The Global Data Network and subsequent Risk Engine Score provide risk scoring, authentication, and risk-based decisioning of transactions, events, and activities within both Outseer 3-D Secure and Fraud Manager.

The Risk Engine Creates a Risk Score

Outseer’s Risk Engine uses a combination of the Outseer Risk Score and user-defined policy rules to set the Allow, Challenge and Decline policy for each transaction type. Customers can use Outseer’s AI-powered risk score to easily challenge or decline their riskiest transactions, or they can write specific rules using individual data elements to achieve a finer degree of control or introduce an expert layer of rules on top of the default score.

The Score Is Refined through the Policy Manager and Case Manager

Decisions made by Policy Manager can be reviewed in Outseer’s Case Manager, where the risk model publishes up to ten AI explainability indicators for the score produced for each transaction, showing the signals that contributed most to the final score, along with a summary of some of the most relevant data points.

Ready to get started?

Discover how easy it is to stop fraud before it happens and know that every transaction is as real as the happy customer behind it by giving your teams the tools to succeed. Explore Outseer's proven solutions today!