As the Cyber Threat Intelligence Team Lead at Outseer, I have the privilege of leading a highly skilled team of multilingual experts who have immersed themselves in the world of fraud and cybercrime.

This blog shares the insights gained from monitoring hundreds of fraudster communication channels on the clear and dark web, engaging with fraudsters, and utilizing advanced research techniques. Let’s dive into the key fraud trends that shaped 2022.

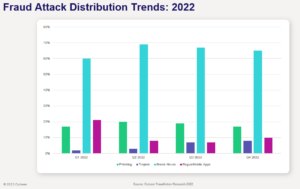

Fraud Attack Distribution

Our analysis of attack type distribution, detected by Outseer FraudAction on behalf of customers, reveals a clear pattern: brand abuse remains the predominant attack vector, comprising over 65% of detected attacks. Phishing follows at 18%, while rogue mobile apps account for 12% and Trojans constitute the smallest portion at 5%.

Looking at the attack types distribution over four quarters, we observe a clear trend: brand abuse attacks are increasing while rogue mobile apps attacks are decreasing. This trend can be attributed to the varying levels of effort required by fraudsters to carry out each attack.

Brand abuse attacks are simple and fast, involving the creation of fake web pages or social media profiles. On the other hand, rogue mobile apps demand significant effort, including developing and uploading applications to various app stores. Consequently, if fraudsters succeed with brand abuse attacks, they have less incentive to invest in more complex attacks such as rogue mobile apps and Trojan attacks.

Notable Fraud Trends in 2022

1. Fraud Trends Emerging from the Russia-Ukraine War

The Russia-Ukraine War, which unfolded in early 2022, had significant consequences on the world’s economy and the realm of fraud. We observed several types of fraud directly related to the war. Fraudsters exploited the situation through donation scams, emotional posts, and 419 scams targeting individuals’ sympathies and willingness to help. Notably, state actors and skilled individuals were involved, using cybercrime as a weapon to harm Ukraine and deceive Westerners.

2. Synthetic Identity Fraud: A Growing Threat

Synthetic Identity Fraud emerged as one of the fastest-growing forms of identity theft in 2022. Fraudsters create synthetic identities by combining real and fake Personally Identifiable Information (PII), making it challenging to detect and combat. These identities are used to build credit histories that resemble those of individuals with limited or no credit history. Fraudsters utilize synthetic identities for various fraudulent activities, including obtaining loans, acting as mule accounts, and engaging in bank-related scams.

3. Android Banking Trojans Are Getting Smarter

The threat landscape witnessed the emergence of new Android Banking Trojans and updates to existing strains of banking malware in 2022. Developers continuously improved these Trojans, incorporating game-changing features and evading security solutions. What makes this trend particularly concerning is the availability of banking Trojans as a service known as Malware as a Service (MaaS), enabling even those with limited technical expertise to launch attacks. State actors from resource-constrained countries also capitalized on this market, outsourcing high-quality malware to carry out sophisticated cyber operations.

4. Check Fraud: A Surging Issue

Despite the increased adoption of electronic payment methods, check fraud remained a pressing concern in 2022. Fraudsters perfected their counterfeiting abilities and are actively trading stolen and counterfeited checks on underground markets. The ease of counterfeiting checks and changing bank policies, such as higher mobile check deposit limits, contributed to the growth of this trend. Check fraud can lead to significant financial losses, particularly when banks always book the loss.

5. Fake Ad Fraud: Exploiting Digital Ad Platforms

Digital ad platforms, such as Google ads, became popular among fraudsters for spreading phishing and malware campaigns in 2022. Victims were exposed to fake ads appearing on search engines and various websites. These ads appeared genuine, luring victims into clicking them, entering credentials, contacting phone numbers, or downloading malware. The accessibility and low costs associated with creating fake ads made digital ad platforms attractive attack vectors for fraudsters.

These five notable fraud trends from 2022 provide a glimpse into the world of fraudsters and cybercriminals online. As the Outseer FraudAction team, we closely monitor fraud groups on different platforms and marketplaces, enabling us to provide organizations with valuable insights and help them combat fraud effectively. Stay vigilant and partner with trusted experts to stay one step ahead of evolving fraud trends in today’s dynamic threat landscape.

If you require further assistance or want to learn more about fraud prevention strategies, watch our on-demand webinar or feel free to contact our team at Outseer. Together, we can protect your organization from the ever-evolving world of fraud.