Let’s just say the fraudsters have it coming. As Outseer rolls out new identity-based enhancements to protect against account takeover (ATO) attacks and account enrollment fraud, I won’t lie to you: It always feels good to implement new ways to put the squeeze on cybercriminal organizations.

Just look at the numbers. Account takeover (ATO) attacks now account for more than $16 billion in annual losses in the just US alone. Account enrollment fraud using compromised identity information contributes to another $56 billion in losses each year. And according to the FBI, at least $6 billion of that can be attributed to the use of synthetic identities—one of the fastest-growing financial crimes in the US.

In other words, the latest enhancements to Outseer Fraud Manager couldn’t come a moment too soon. Powered by machine learning, data science, and real-time risk scoring, Outseer Fraud Manager protects logins and transactions originating from digital user accounts with a 95% fraud prevention rate and just 5% intervention.

That’s the best performance in the industry. And it’s predicated on our belief that setting up or accessing an account should be absolutely seamless for legitimate users, and that step-up challenges should be reserved for only the scan few that warrant further scrutiny. By transparently authenticating users behind the scenes, we prevent fraudulent access or activity before it happens—while reducing user friction.

And now, we’re layering in additional, biometric capabilities to help banks, merchants, and others further protect the end-to-end user journey while delivering a fast, friendly user experience. Enhancements include:

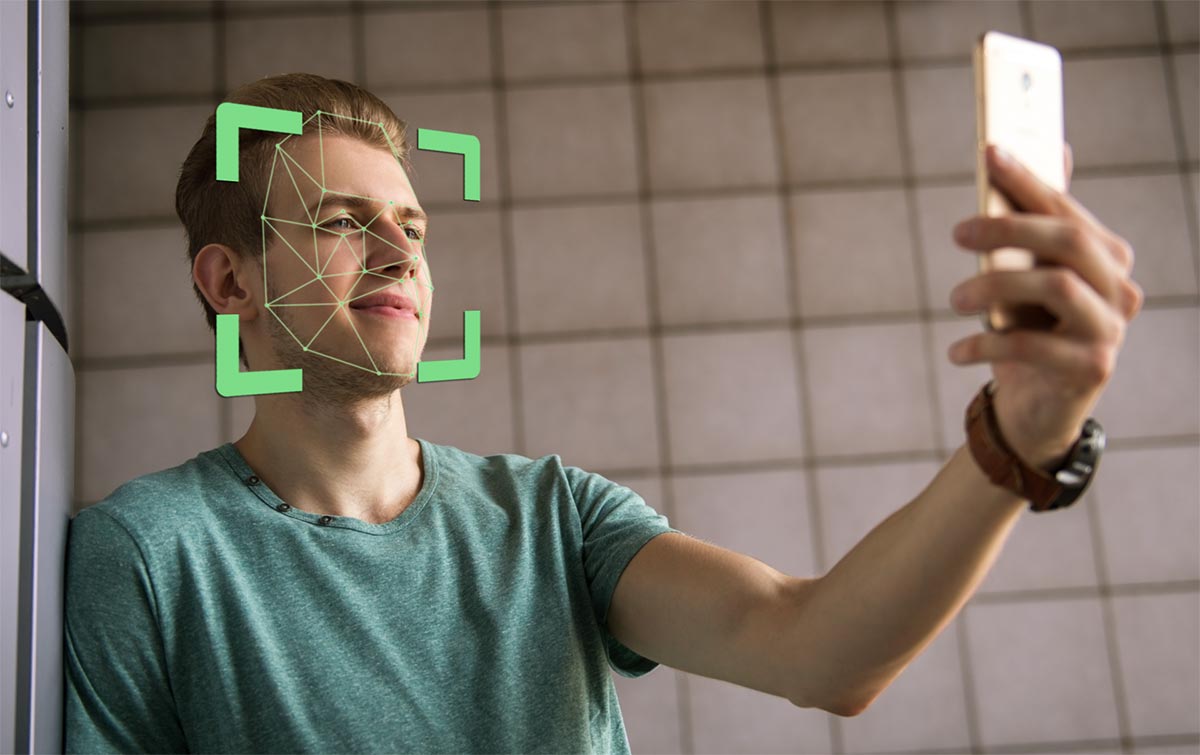

Effortless ID Verification at Enrollment

Outseer Fraud Manager customers can now enroll users into new digital services, leveraging biometric facial detection capabilities to prevent fraudsters from opening new accounts with stolen or synthetic identity information. The technology powering this capability validates a live human face against a government-issued ID, and facilitates document verification against third-party databases.

Kicking Account Compromise to the Curb

This same facial recognition tech can be leveraged for even stronger controls against account compromise attempts. Among other things, this solution leverages FIDO2 compliant biometrics for strong authentication in case of a high-risk transaction or digital activity. Also very cool: It allows passwordless authentication to be selected as the primary method of authentication during sign up. Given the fact that the typical person has 100 different passwords to lose or forget, this will be as welcome as it is fraud-proof.

Outseer Beyond™: Building Momentum

Together, these enhancements are just the latest example of the Outseer Beyond™ partner program in action. Through this ecosystem, third-party providers help expand the scope and reach of our ant-fraud products to a worldwide customer and partner community.

This is also just the latest marker in our mission to liberate the world of transactional fraud. As adoption of digital channels continues to accelerate, we’ll be there to help organizations easily distinguish between friend and foe—while erasing user friction. Like I said, the fraudsters have it coming.